2025 Tax Brackets Single Head Of Household

2025 Tax Brackets Single Head Of Household. The internal revenue service (irs) adjusts income thresholds for each. See current federal tax brackets and rates based on your income and filing status.

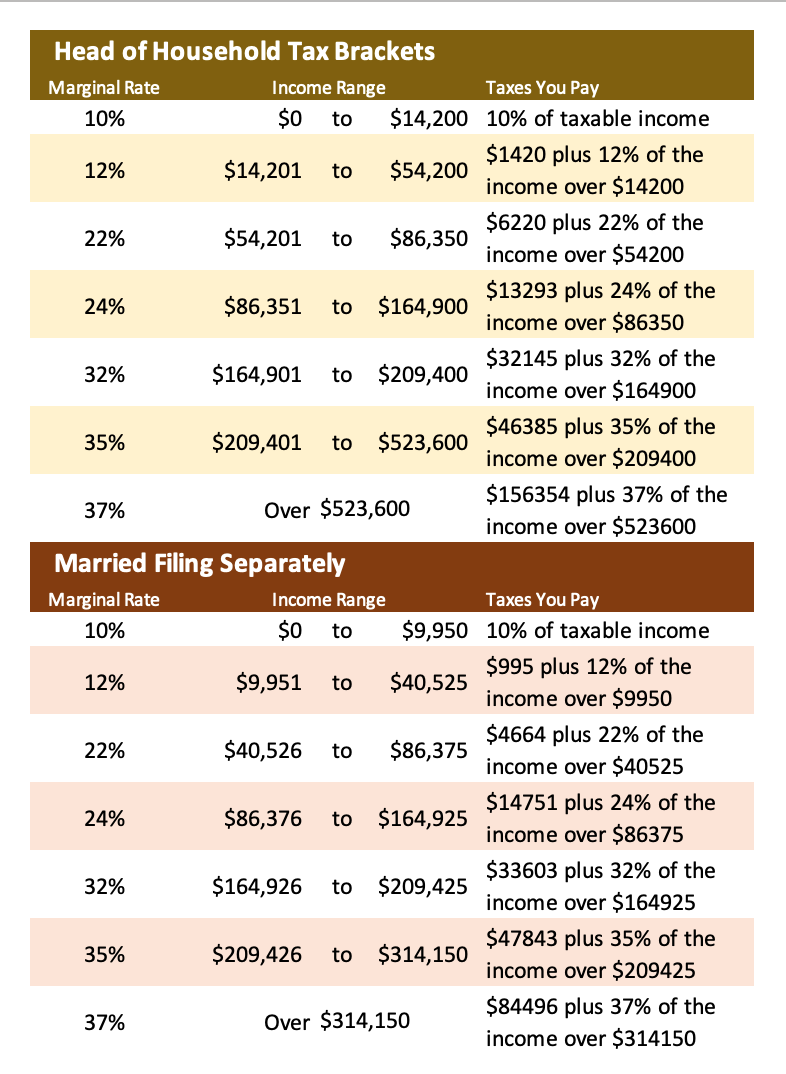

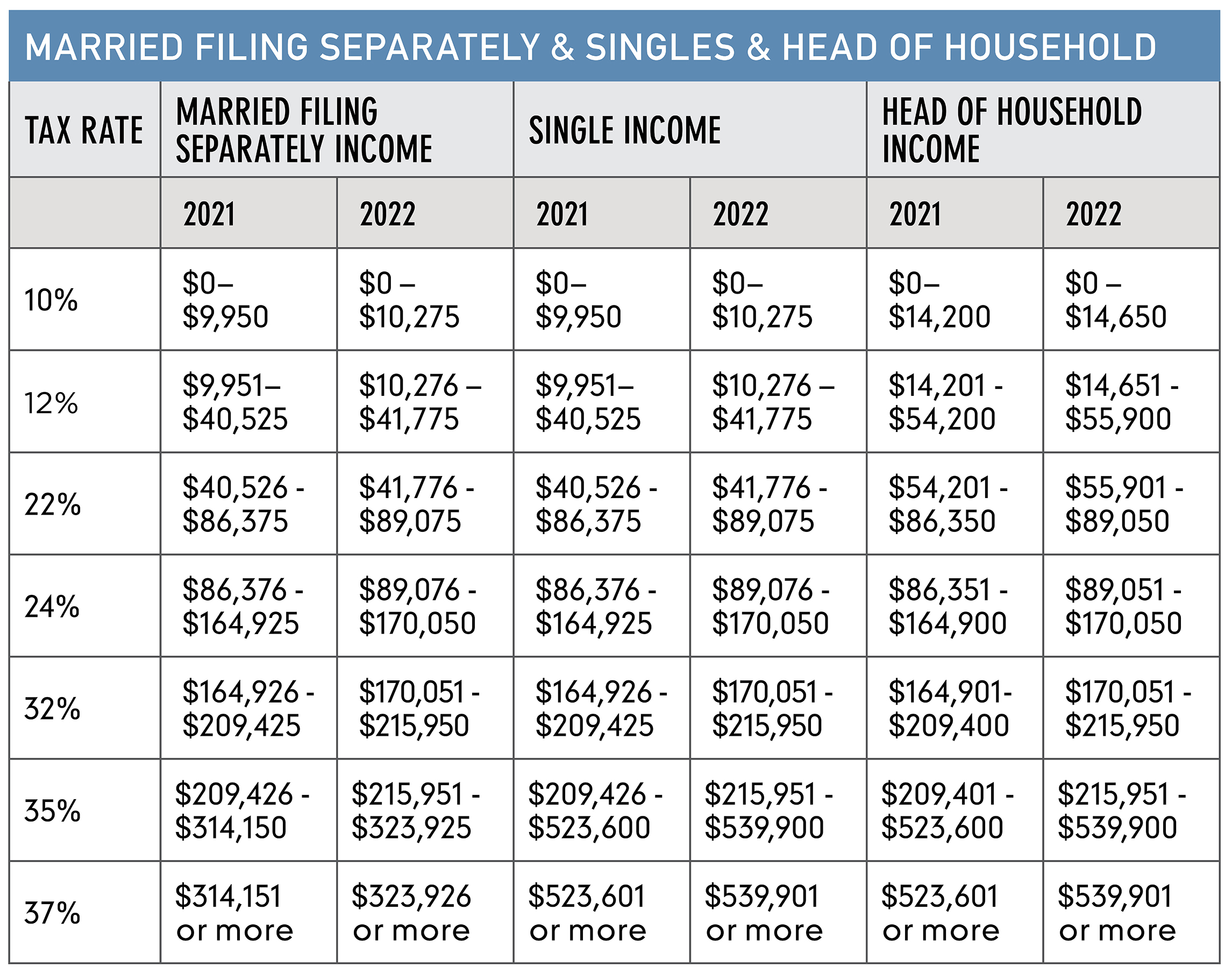

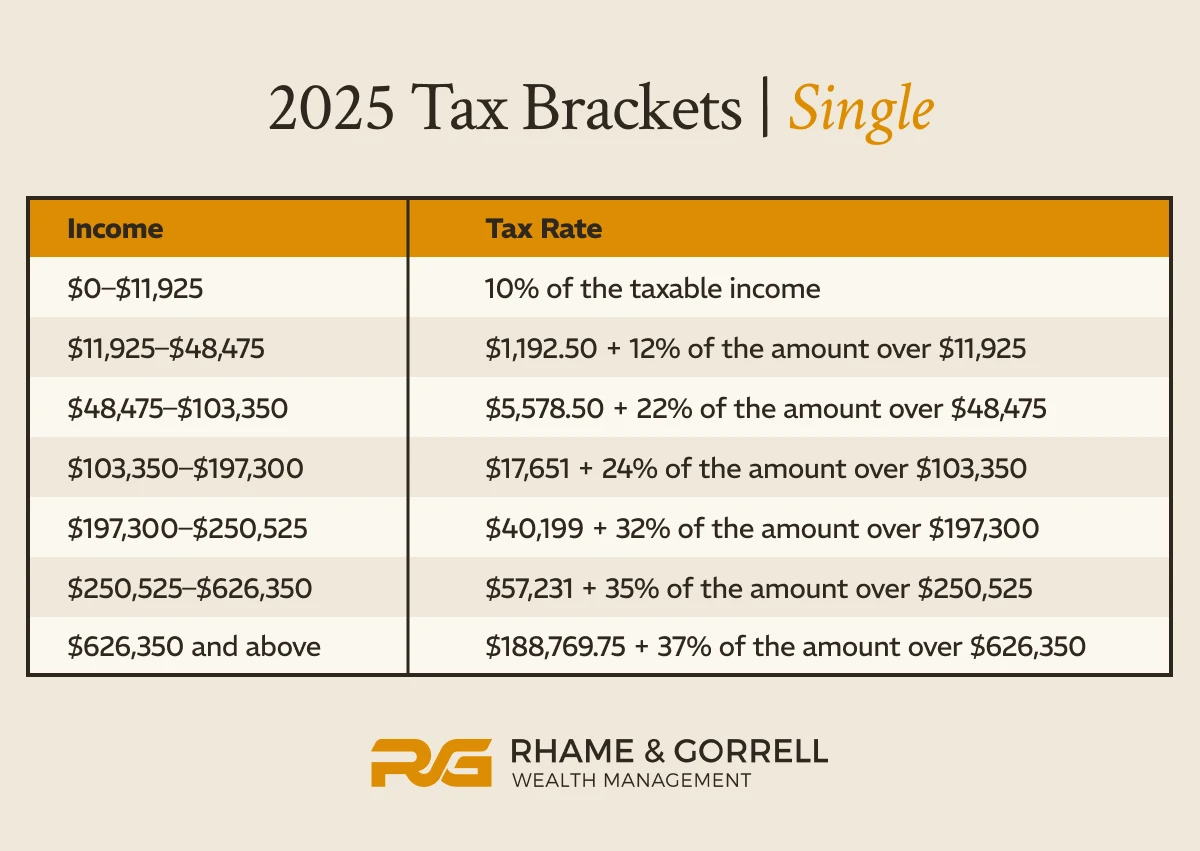

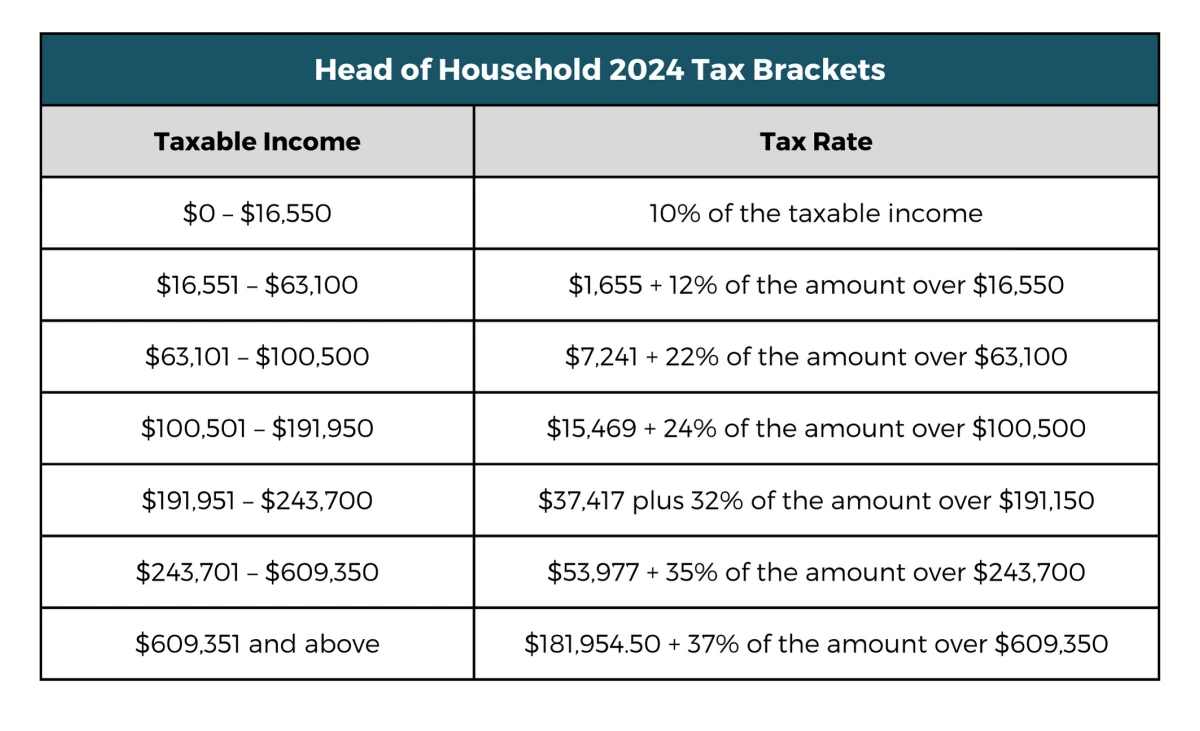

The federal income tax has seven tax rates in 2025: The seven federal tax rates—10%, 12%, 22%, 24%, 32%, 35%, and 37%—remain unchanged for 2025. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

See Current Federal Tax Brackets And Rates Based On Your Income And Filing Status.

The federal income tax has seven tax rates in 2025: The seven federal tax rates—10%, 12%, 22%, 24%, 32%, 35%, and 37%—remain unchanged for 2025. For example, if you’re a single filer in 2025, and you have taxable income of $60,000 a year, you’ll be in the 22% tax bracket.

Each Bracket's Rate Ranges Also Differ Based On The Filing Status (Head Of Household, Married Filing Separately, Married Filing Jointly And Qualified.

10%, 12%, 22%, 24%, 32%, 35%, and 37%. To figure out your tax bracket, first look at the rates for the filing status you plan to use: The internal revenue service (irs) adjusts income thresholds for each.

Find The 2025 Tax Rates (For Money You Earn In 2025).

Single, married filing jointly, married filing. 2025 federal income tax brackets and rates for single filers, married couples filing jointly, and heads of households. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

As In Prior Years, There Are Seven Tax Brackets For Individual “Regular” Income:

The standard deduction amounts can be.